The Numbers for 2023 - Big Changes

The IRS has recently announced updated inflation-adjusted contribution and deduction limits for 2023.

Below is a brief list of the most requested information:

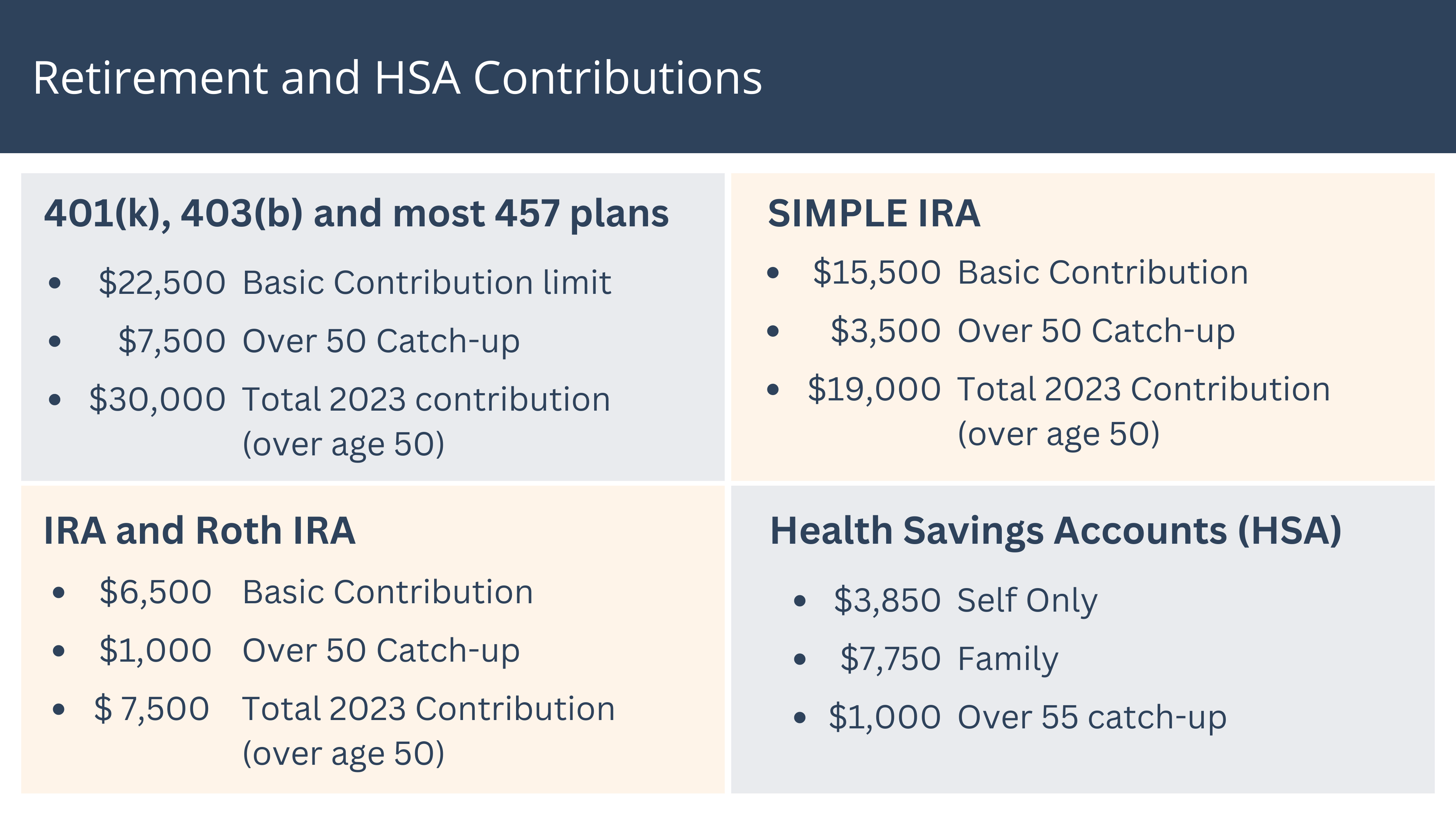

Retirement and HSA Contributions

401(k), 403(b) and most 457 plans

- $22,500 Basic Contribution limit

- $ 7,500 Over 50 Catch-up

- $30,000 Total 2023 contribution (over age 50)

IRA and Roth IRA

- $ 6,500 Basic Contribution

- $ 1,000 Over 50 Catch-up

- $ 7,500 Total 2023 Contribution (over age 50)

SIMPLE IRA

- $15,500 Basic Contribution

- $ 3,500 Over 50 Catch-up

- $19,000 Total 2023 Contribution (over age 50)

Health Savings Accounts (HSA):

- $3,850 Self Only

- $7,750 Family

- $1,000 Over 55 catch-up

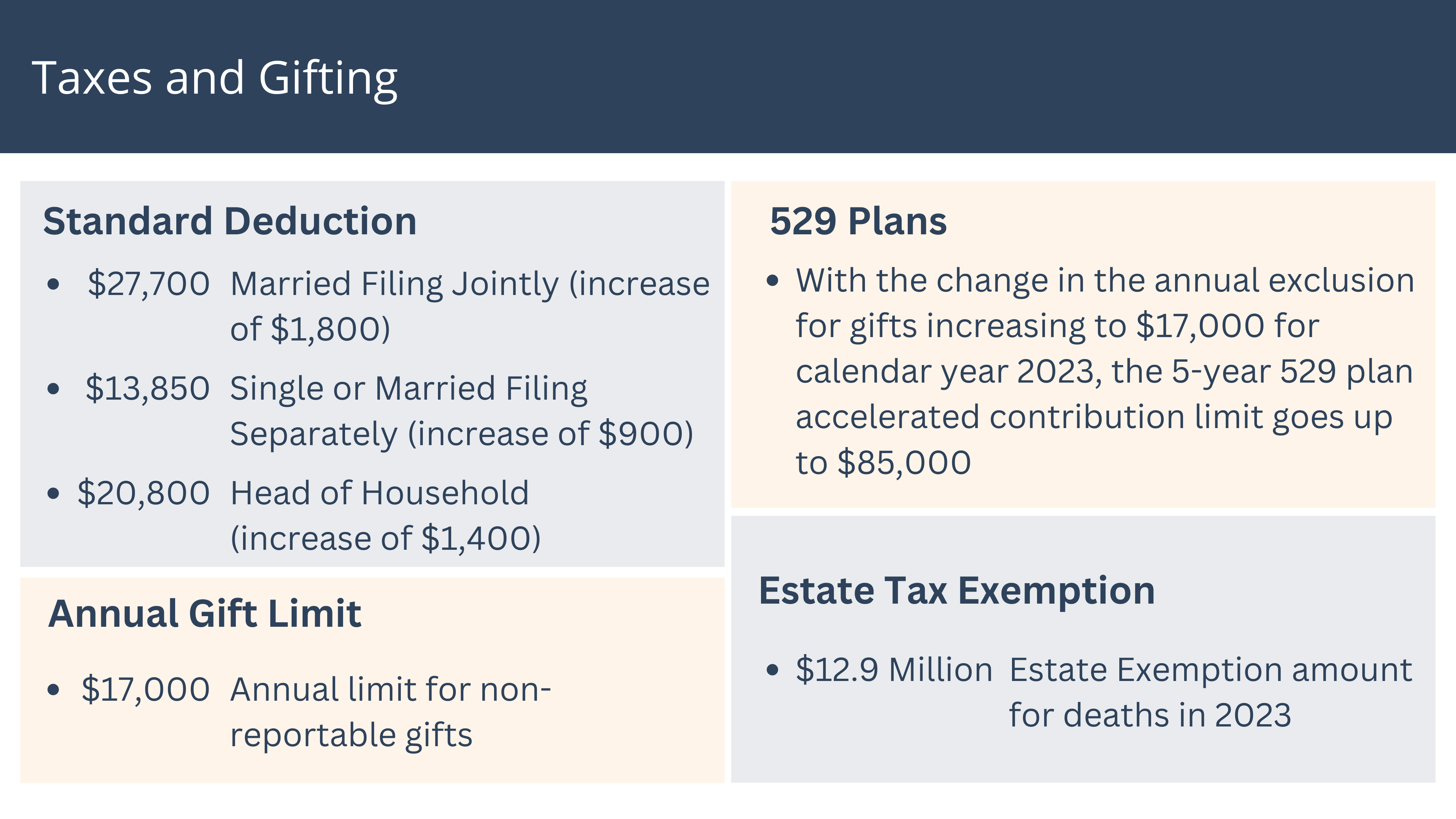

Taxes and Gifting

Standard Deduction:

- $27,700 Married Filing Jointly (increase of $1,800)

- $13,850 Single or Married Filing Separately (increase of 900)

- $20,800 Head of Household (increase of $1,400)

Annual Gift Limit:

- $17,000 Annual limit for non-reportable gifts

529 Plans:

- With the change in the annual exclusion for gifts increasing to $17,000 for calendar year 2023, the 5-year 529 plan accelerated contribution limit goes up to $85,000

Estate Tax Exemption:

- $12.9 Million Estate Exemption amount for deaths in 2023

If you have any questions, please reach out.

We are here to help!

Important Information

Advisors Financial, Inc. (“AFI”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where AFI and its representatives are properly licensed or exempt from licensure.

The information provided is for educational and informational purposes only and does not constitute investment advise and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.