NEWSLETTER: Finding Clarity in a Foggy Rate Environment

Third Quarter 2022 Market Summary:

- Stubbornly high inflation drove the Fed to raise rates twice and increase its estimates for future rate hikes, fueling more market volatility

- Job market growth remained robust: The unemployment rate fell to 3.5%, the lowest level since before the pandemic, and added 1.1 million jobs during the quarter

- The odds of recession as early as 2023 increased as more aggressive rate hikes make a “soft landing” more difficult to achieve

- Stocks once again appear cheap relative to historical averages, suggesting higher long-term returns, although we see potential for further downside in the near-term as stocks face three primary headwinds: inflation, recession concerns, and geopolitical risk

- Bond yields are the most attractive they have been in years, offering investors the chance to earn higher income without sacrificing quality

- Investors are best served by maintaining discipline and staying the course

Market Analysis

After staging an impressive rally to start the quarter, stocks gave up their gains and closed lower by -5.28% as measured by the S&P 500, driven by stubbornly high inflation and fears of an increasingly hawkish Federal Reserve. Despite higher interest rates weighing heavily on asset prices, job market strength continued throughout the quarter. The unemployment rate fell to 3.5%, its lowest level since before the pandemic. A total of 1.1 million jobs were added during the quarter, bringing the total of jobs added through the first nine months of the year to almost 3.8 million.

The Fed raised interest rates by 75 basis points (0.75%) both in July and September, increasing the target interest rate to 3.00-3.25%, and raised its estimate for the “terminal rate” to 4.6% in 2023. Investors had previously hoped that the Fed might slow down the pace of hikes after the July meeting. At the Jackson Hole symposium in August, Chairman Powell reiterated the Fed’s intent to fight inflation at all costs, stating that higher rates would “bring some pain to business and households.”[i]

All these messages stoked fears that the Fed could make a policy mistake by raising rates too high, increasing the risk of a “hard landing” in the economy. Fed tightening cycles have preceded each of the last 10 recessions, and we don’t expect this time to be any different. We think the economy could enter a mild recession as early as next year. It is important to note, however, that stocks typically bottom before we even know we are in recession, or before recession ends.[ii]

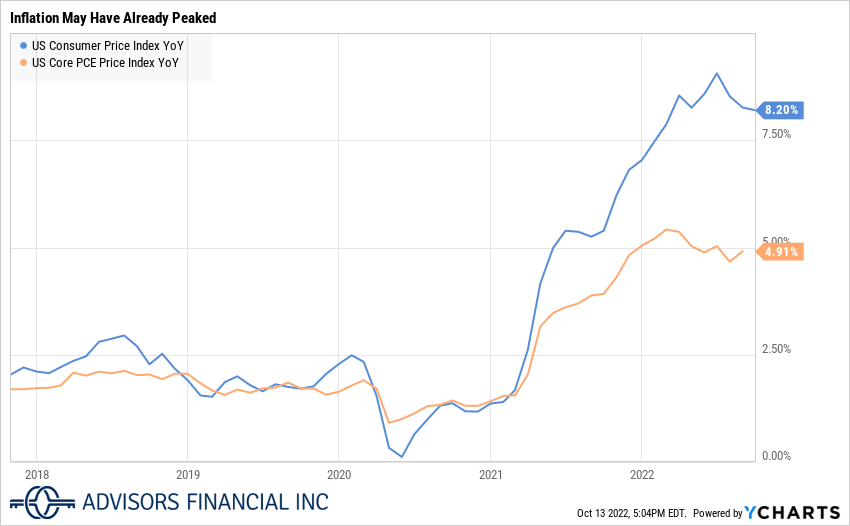

Inflation appeared to have peaked in June but remained high throughout the quarter. This is in large part due to rising shelter costs, but partly due to the continued food and energy crisis resulting from Russia’s war in Ukraine. The Consumer Price Index fell to 8.2% in September from a cycle high of 9.06% in June. While the Fed’s preferred measure of inflation, Core Personal Consumption Expenditures (PCE), fell to 4.91% in August from a high of 5.42% in February, it remains well above the Fed’s 2% inflation target.

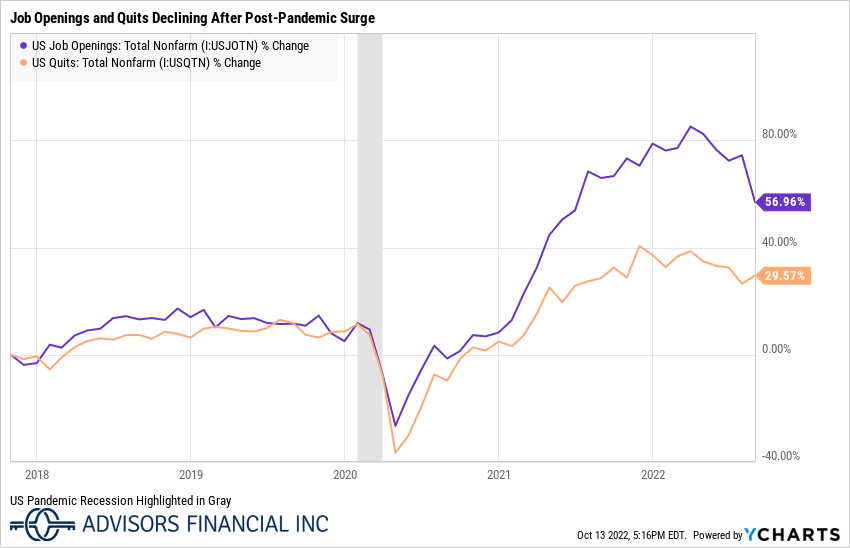

We believe the Fed must see weakness in labor market conditions before it is willing to slow or pause rate hikes. There is already some early indication that labor markets are starting to cool: Job openings fell to just over 10 million in August after peaking at 11.86 million in March, and job quits stabilized at a little more than 4 million.

Elsewhere in the economy we are seeing signs that inflation may continue to fall. The Federal Reserve Bank of New York Global Supply Chain Pressure Index (GSCPI)[iii], which tracks transportation costs and manufacturing indicators to measure the stress on the global supply chain, has declined dramatically.

Higher rates have also weighed significantly on the housing market, which had a big runup following the pandemic. Pending home sales declined by 24.19% year-over-year in August as mortgage rates surged. As of this writing, the average 30-year fixed rate stood at 7.04% according to Bankrate.com. The Zillow Home Values Index increased by 16.5% year-over-year as of August 31st, however month-over-month increases declined to 0.28%, well below the 12-month average of 1.28%[iv].

Shelter costs are the largest component of the CPI inflation measurement, and the methodology for calculating rents means there is typically a lag between real-time increases in home prices and increases in shelter inflation. Rents and “owner’s equivalent rents” will likely continue to contribute to high inflation over the next few months.

After the August rally waned, stocks are once again looking cheap relative to history. The forward price-to-earnings (P/E) ratio of the S&P 500 fell to 15.1x at the end of the quarter, below the 25-year average of 16.84x. Valuations don’t have much predictive power in the short-term, but over longer time periods lower forward P/E ratios are correlated with higher subsequent returns[v].

While we think that stock valuations are attractive at these levels, we caution that they could be subject to further downside in the near-term, so stock investors must be patient. Stocks face challenges on three primary fronts: high inflation (the primary driver of negative returns), recession concerns, and geopolitical risk. If inflation remains high, further rate increases could drive valuation multiples lower. If recession odds increase, earnings estimates (the “E” in the “P/E” ratio) are likely to be revised lower. Escalation of Russia’s war in Ukraine could also weigh on stocks, but geopolitical risk is very difficult to quantify.

Since these risks are currently weighing on the minds of stock investors, good news, or a “positive surprise,” on any of the three fronts could provide a significant boost to stock prices.

Bond investors are also presented with attractive yields following price declines caused by the fastest rate hiking cycle since the early 1980s[vi]. Investors can earn more income than in years past without the need to sacrifice quality. A 2-Year Treasury note, for example, yielded over 4.1% at the end of the quarter – a higher yield than at any point in the last 10 years.

The decline in bond prices is one of the main reasons why this year’s selloff has felt so painful. Investors typically think of bonds as ballast to their stock portfolio, but as we have seen so far this year, bonds can suffer sizeable declines during periods of high inflation and rising rates. We think that most of the pain has already been felt in bond markets, particularly in bonds with longer duration, and that yields will be the primary driver of total returns going forward. When rates stabilize, we expect that bonds could begin to perform better from here, but they are still likely to face some volatility in the near-term as the Fed continues to raise interest rates towards its target.

Time in the Market, Not Timing the Market

During periods of heightened uncertainty and market volatility you often hear us recommend that the best course of action for investors is to stay the course. Staying invested during bear markets can be very difficult, but we believe it is the right thing to do.

Our goal is to build durable, “all-weather” portfolios for clients that align with their risk tolerance and long-term goals. We expect that these portfolios must weather rough seas from time to time and believe that staying the course gives investors the best chance to achieve their goals. We continuously monitor market conditions, evaluate opportunities, and stand ready to reallocate portfolios or make “course corrections” if necessary, but we do not actively engage in market timing.

The reality is that bear markets, defined by drawdowns of 20% or more, are a normal feature of functioning markets. Since 1945 there have been 14, not including this one. That means on average an investor can expect one bear market every 5.4 years.[vii]

Corrections, or declines of 10% or more, happen even more frequently. Corrections have occurred in 10 out of the last 20 years, and stocks ended with positive returns in all but three of those years.[viii]

Even though we know that corrections and bear markets happen with regularity, without a crystal ball there is no reliable way to predict or time them, let alone to determine whether a correction might turn into a bear market. Hindsight is 20/20, so it is easy to look back at a chart and say, "I should have sold" or "I should have bought," but doing it in real time is a different story.

Research by JPMorgan highlights just how costly trying to time markets can be.[ix] An investor that stayed fully invested in the S&P 500 from January 1st, 2002 to December 31st, 2021 would have earned a 9.52% annualized return. If that investor missed only the 10 best days during that period, their return drops to 5.33%. Missing the 20 best days slashes the return to 2.63%, and if they somehow miss the 40 best days, their annual return is negative.

Taking this into account you can see why we choose to avoid getting into the business of market timing. Instead, we stay invested and try to add value in other ways. When markets are down substantially, we rebalance portfolios back to target allocations. In taxable accounts, we actively harvest losses, selling investments to realize losses and buying similar investments to continue to participate in the market and an eventual recovery in prices. Harvested losses can then be used to offset future gains, reducing tax liabilities.

As always, feel free to contact us if you have any questions.

|

|