First Quarter 2023 Market Commentary: Preparing for a Range of Outcomes

Preparing for a Range of Outcomes

First Quarter 2023 Market Summary:

-

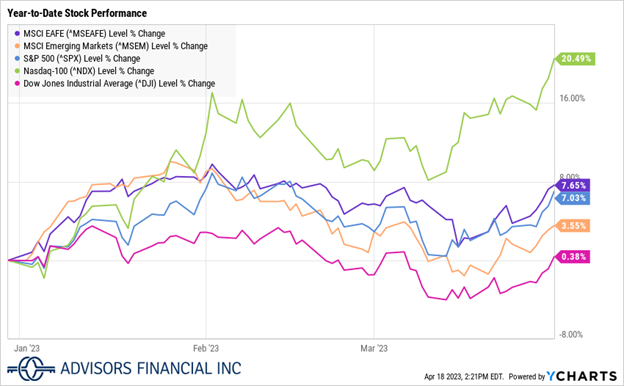

US stocks gained in the quarter with the S&P 500 up 7.03% and the NASDAQ 100 surging 20.49%, driven by expectations of the end of the Fed’s rate hiking cycle.

-

International stocks rose, supported by a warmer than expected European winter, weakening US Dollar, and China’s economic reopening.

-

Despite the recent outperformance of stocks, we think bonds still provide attractive income opportunities for investors.

-

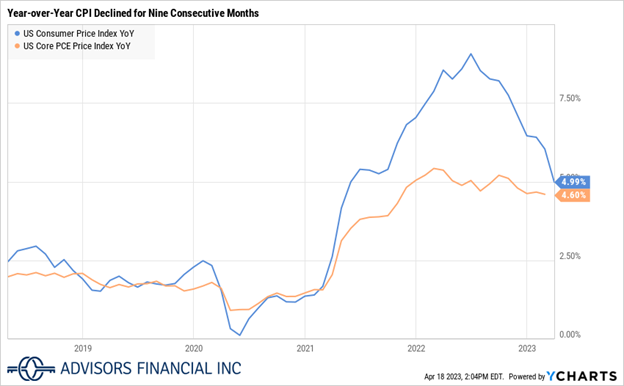

Inflation trended downward, with the CPI at 4.9% year-over-year in March, its ninth consecutive decline.

-

Silicon Valley Bank’s collapse, the second largest bank failure in US history, revealed poor management but not systemic risk to the banking sector.

-

Increased risk of a mild economic slowdown in the second half of 2023, or early 2024, calls for a balanced investment approach.

-

Diversification is crucial in this environment; investors are best served by maintaining discipline and staying the course.

Market Analysis

Stocks continued to grind higher in the first quarter, with the S&P 500 gaining 7.03% and the Dow Jones Industrial Average up by 0.38%. The NASDAQ 100 rallied by 20.49% after suffering a 32.97% decline in 2022. These advances were primarily fueled by expectations that the Federal Reserve is nearing the end of its rate hiking cycle. After back-to-back 25 basis point (0.25%) rate hikes in February and March, the market is currently predicting one final 25 basis point increase in May, followed by cuts beginning as early as September. Anticipation of a stable – and potentially lower – rate environment was a boon to the beleaguered technology sector, which led the stock market higher.

In international markets, the MSCI EAFE index of developed countries gained 9.72% during the quarter, while the MSCI Emerging Markets index rose 4.96%. A combination of a warmer than expected European winter and continuation of US dollar weakness helped to drive international stocks higher. Emerging Markets saw a boost from China’s economic reopening as it moved away from its zero-COVID policy.

The US economy added 1.03 million jobs during the first quarter. The unemployment rate remained unchanged at 3.5%, while the four-week average of initial claims for unemployment insurance ticked up to over 240,000 from approximately 209,000 at the beginning of the year. To provide some context, the four-week average of unemployment claims peaked at more than 650,000 during the financial crisis, and over 5 million during the COVID lockdowns.

Inflation continued its downward trend during the quarter. The Consumer Price Index (CPI) fell to 4.98% year-over-year in March. Though it remains well above the Fed’s 2% target for inflation, March marked the ninth consecutive month of year-over-year declines in CPI. Meanwhile, the Fed’s preferred inflation gauge, Core Personal Consumption Expenditures (PCE), fell to 4.6% in February.

We anticipate that inflation will continue to fall throughout the remainder of the year, especially as the lagged impact of higher housing costs wanes.

The biggest news of the quarter was the surprise collapse of Silicon Valley Bank, the second largest bank failure in US history, and the first since the 2008 financial crisis. The technology startup-focused bank attempted to raise capital after liquidating long-term government bond holdings at a loss, which only served to accelerate withdrawals leading to a run and its failure.

It is not unusual to see rising interest rates, especially at the pace and magnitude of this tightening cycle, cause cracks in the economy. In the case of SVB however, we think that the high interest rate environment simply exposed poor management of assets and idiosyncratic risk at the bank, and it is not representative of a systematic risk to the banking sector. To alleviate investor and depositor worries, and to prevent SVB from becoming a systemic issue, a coordinated government effort took place to back-stop depositors and allow banks to borrow against otherwise “money good” government bonds in their held-to-maturity portfolios.

Looking Ahead

Our base case view for the markets in 2023 calls for continued equity volatility. We believe there is a better than 50% chance of a mild recession in the second half of the year, but we also acknowledge that there are positives in the economy and that avoiding a recession is not out of the question.

|

We expect to see more volatility in markets for several reasons:

|

|

At the same time, we recognize positives in the economy today including:

|

|

While we tend to look at the US economy with optimism, we are also realists. History suggests that interest rate tightening cycles are almost always followed by rising unemployment and recession. It is not outside of the realm of possibility that we avoid recession, but it would seem highly unlikely. In our view, the positives in the economy are less a signal that recession could be avoided and more of one that the recession we do forecast will be mild, especially compared to the financial crisis and COVID. The tough question for the remainder of the year is have we already seen the lows in stocks, or could there be more pain to come? The answer is not so clear cut and highlights why we believe being overly bullish or bearish in this environment can lead to poor outcomes.

In October 2022, the S&P 500 stock market index reached its lowest level for the year, closing at 3,577. By the end of March this year, it bounced back to 4,109. In October, the forward price-to-earnings (P/E) ratio, which helps us understand the stock market's value, was just below its 25-year average of 16.8 times. By March 31st, this ratio went up to 17.8 times[i]. The forward P/E ratio compares the current price to the expected earnings over the next year.

We believe there's a higher chance of the economy slowing down later this year, which means that the predictions for earnings over the next 12 months might be too high. If the economy slows down and earnings decrease, either the forward P/E ratios will go up, or stock prices will go down. Since interest rates are high and the Federal Reserve plans to keep them stable for some time, we think it's more likely that stock prices will decrease. It's hard to say how much they might fall, but we wouldn't be surprised if they go back near the lower levels we saw in October as the market adjusts to the potential economic slowdown.

As we've mentioned before, it's crucial to understand that the stock market looks ahead and often reaches its lowest point before a recession officially ends. Stock prices are affected by many things, such as current and expected interest rates, expected earnings, global politics, and other changing factors. Keeping this in mind, it's possible that the stock market has already reached its lowest point and won't go back to previous low levels.

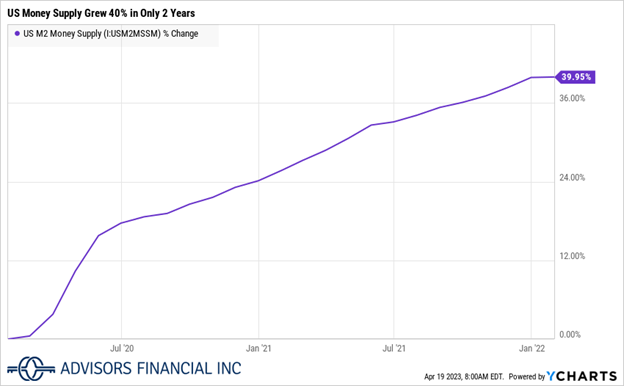

The reality is that forecasting the economy is difficult in this environment and investors must be prepared to face a wide range of outcomes. The post-2020 economy has experienced several firsts, including the largest expansion of the money supply in history (+40% from February 2020 to February 2022) and subsequently the fastest rate tightening cycle in history. |

While the outlook for the stock market is less than certain, we are much more confident in our view of bond markets over the next several years. As we have stated in previous newsletters, we find that bonds offer attractive yields at attractive prices, representing good value for investors over the short and long term. With yields at or near the highest levels we have seen in over a decade, bonds are finally offering investors appreciable income opportunities. Because yields on quality government and corporate bonds are so much higher now than in recent years, investors no longer need to go down in quality to seek income.

While rising interest rates are bad for most bond prices, a pause in rate hikes (and subsequent rate cuts) provide a tailwind for bond investors. According to research by PGIM Investments[ii], bond returns have been positive 100% of the time over the six-month, one-, three-, and five-year time periods following the last Fed rate hike in each of the seven previous tightening cycles.

Short and long-term bonds also tend to outperform Certificates of Deposit (CDs) in the one-, three-, and five-year periods following the peak in 1-Year CD rates[iii]. This is an important factor for investors to consider when interest rates have peaked and are likely to decrease in the future. In a falling interest rate environment shorter term bond investments can be subject to greater reinvestment risk – or the risk of earning less money in a new bond because interest rates dropped when the old bond matured.

Given the wide range of potential outcomes for markets we believe investors should avoid overly bullish or bearish positioning in their portfolios, and instead take a balanced approach regarding both stocks and bonds. In our view, a diversified allocation has never been more important than now.

We pride ourselves in collaborating with our clients to develop thoughtful investment plans to help them reach their goals. As we continue through this year, we believe investors continue to be best served by maintaining discipline and focusing on the long-term view. We will continue to evaluate opportunities to reallocate portfolios as the investment environment evolves, and in taxable accounts we actively look to take advantage of volatility and add value by tax-loss harvesting.

Feel free to contact us if you have any questions.

[i] JPMorgan. Guide to the Markets, Slide 5. https://am.jpmorgan.com/us/en/asset-management/institutional/insights/market-insights/guide-to-the-markets/

[ii] PGIM Investments. Spotlight on the Markets. https://www.pgim.com/investments/article/bonds-historically-provided-consistent-positive-performance-after-fed-pauses

[iii] PGIM Investments. Spotlight on the Markets. https://www.pgim.com/investments/article/bond-funds-tend-outperform-cds-after-peak-rates

Important Information

Advisors Financial, Inc. (“AFI”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where AFI and its representatives are properly licensed or exempt from licensure.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.