Cautious Optimism in a New Year

Fourth Quarter 2022 Market Summary:

- Stocks advanced during the quarter with the S&P 500 up 7.08% and Dow Jones

- Industrial Average up 15.39% to close the year down 19.44% and 8.93% respectively.

- Inflation continued to cool during the quarter but remained well above the Fed’s 2% target, leading it to raise interest rates twice in November and December, and raise its terminal rate estimate to 5.1%.

- The economy added 742,000 jobs during the quarter to bring the 2022 total to 4.5 million. The unemployment rate fell to 3.5%.

- Stock price-to-earnings ratios increased compared to the third quarter lows but remain in line with 25-year averages.

- Bond yields across the board traded at or near 10-year highs.

- Investors are best served by maintaining discipline and staying the course.

Q4 Market Analysis

Stocks rallied in the fourth quarter as inflation continued to cool after peaking earlier in the summer. This provided some much-needed relief to investors after one of the most tumultuous years in recent memory. The S&P 500 gained a modest 7.08% to finish the year down 19.44%, while the Dow Jones Industrial Average rose an impressive 15.39% to pare its full year losses to 8.93%. Interest-rate sensitive technology stocks did not fare as well; the NASDAQ slipped 0.29% to close the year down 32.97%.

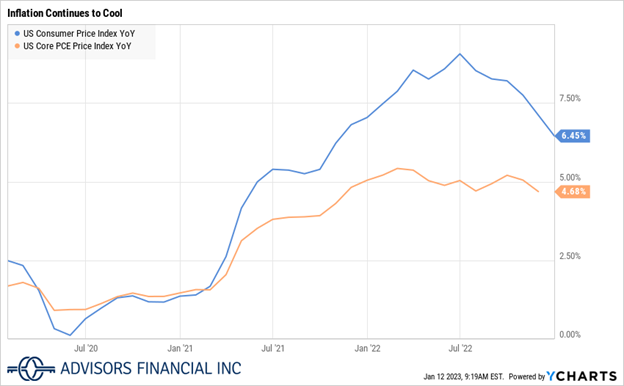

The trajectory of inflation during the quarter was promising but remained well above the Fed’s 2% target. The headline Consumer Price Index (CPI) fell to 6.5% year-over-year in December, down from 8.2% in September and the peak of 9.06% in June. The Fed’s preferred measure of inflation, Core Personal Consumption Expenditures (PCE), declined only slightly to 4.68% in November, compared with its peak of 5.42% in February. The official PCE report for December has not yet been released as of this writing, but the Cleveland Fed’s “Inflation Nowcast” estimates a decline to 4.45%1.

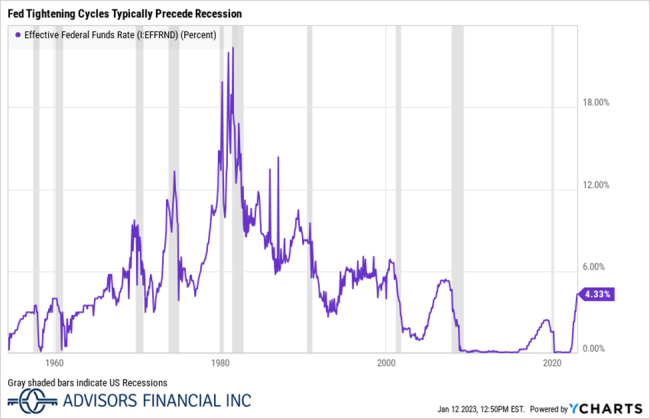

Despite cooling down in the later half of the 2022, inflation still represents a difficult challenge for the Federal Reserve, which raised interest rates by 75 basis points (0.75%) in November and 50 basis points (0.50%) in December, increasing the current interest rate target to 4.25-4.5%. Citing continued inflationary pressures and economic

strength, the Fed once again raised its median estimate for the terminal rate (the level where the Fed anticipates stopping rate hikes), which now stands at 5.1%, up from 4.6% in September.

Inflation is expected to fall further in 2023. The Fed estimates that core inflation will end the year at about 3.5%, in line with our expectations.

Labor market strength continues to make life difficult for the Fed as it battles inflation. Despite rising costs for businesses and consumers, the economy showed remarkable resiliency in 2022. 742,000 jobs were added during the fourth quarter, bringing the total of jobs created during the year to an impressive 4.5 million. While the pace of job growth slowed in the four quarter, it remained quite strong and raises questions about the effectiveness of the Fed’s rate hikes.

Like many investors, we believe the Fed is looking for concrete evidence that hiring activity is slowing appreciably before it pauses rate hikes. If job growth continues at a strong pace well into 2023, it could lead the Fed to raise interest rates higher than current expectations. That said, we do believe the slowdown in the pace of growth will continue and that the impact of rate hikes to date will lead to a contraction in labor markets. As of its December projections, the Fed expects that the unemployment rate will rise to 4.6% in 2023. We are already seeing many tech firms announce hiring freezes and layoffs2 and expect that trend will continue.

Nobel laureate economist Milton Friedman described monetary policy as having long and variable lags between implementation and changes in the economy. In its December FOMC statement, the Fed acknowledged these lags and signaled that a slowdown in the pace of rate hikes was warranted, stating that it “will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments3.”

This acknowledgement is welcome news to us as it suggests the Fed will take a calculated approach to avoid over-tightening, but we do not expect it to roll back rate hikes anytime soon. At the December FOMC meeting press conference, Chair Jerome Powell warned against cutting rates too soon, saying that history “cautions strongly against prematurely loosening policy. We will stay the course until the job is done4.”

Our research has shown that the Fed has usually raised interest rates above the level of inflation during past tightening cycles in an attempt to stop it from accelerating. We do not think that will be the case this time, mainly because inflation already appears to be decelerating. Once the terminal rate is reached, we think the Fed will hold rates steady for an extended period – likely not cutting interest rates until later in 2023 or sometime in 2024.

Looking Ahead

What does this mean for investors? As we wrote in our third quarter newsletter, Fed tightening cycles have preceded each of the last ten recessions, and we do not think this time will be any different. With inflation slowly trending lower and interest rates approaching the Fed’s estimated terminal rate, the primary driver of market volatility will likely shift from rates and inflation to corporate earnings. The question is – what will a recession look like if one does occur? We do not see the structural excesses of 2008 and do not anticipate another global pandemic, so we think it could be quite mild.

A good thing for investors to keep in mind is that stocks typically bottom before we know we are in recession or before the recession ends5. Stocks are already trading well below their post-COVID highs, so even if the economy enters recession, we think that price declines may be less significant than some investors might otherwise expect. In baseball terms, we think we are in the seventh inning stretch of what we hope is a 9-inning game.

Last quarter we stressed the importance of staying the course to achieve investment goals. We believe it is always important for investors to maintain discipline and think that will be especially important this year. After a rocky 2022 we find ourselves amid a bear market facing the possibility of recession, yet we are finding reasons to be cautiously optimistic. Stock valuations have pulled back to historical averages from lofty highs, potentially signaling higher long-term returns. At the same time, bond yields have risen to multi-year highs providing investors with high income without the need to take on excessive risk.

Stock valuations ended the quarter in-line with historical averages. The S&P 500 forward price-to-earnings (P/E) ratio rose to 16.7x from 15.1x at the end of September but is well below the cycle peak of 21.4x in January 20226. While P/E ratios are not particularly predictive of short-term returns, lower P/Es are more correlated with higher long-term returns. For long-term investors we think stocks are attractive at current levels, however the short-term outlook is uncertain, and we expect volatility to persist throughout much of this year.

What might differentiate the next stock market recovery from recent “V-Shaped” recoveries is a higher interest rate environment. With inflation expected to remain above the Fed’s 2% target for some time, it is unlikely that the Fed will cut rates any time soon. Holding rates at higher levels than in recent years may limit P/E multiple expansion, therefore stock returns would primarily be driven by earnings growth. To put it simply, investors should not expect a rapid recovery in stock prices like we saw in 2020 and 2021, but rather more modest returns.

Bond markets on the other hand look more attractive on a relative basis, especially over the short-term. Because interest rates rose so much in the last year, yields-to-worst across most fixed income sectors are at or near 10-year highs7, marking what we believe is an attractive entry point. We think that current yields are sufficient to cushion the impact of further rate increases and a modest increase in default rates should the economy enter recession.

Unlike in 2022 when bonds suffered significant losses due to rising interest rates, we think they will function as ballast in portfolios to deliver income and stability for investors while stocks find their footing.

We pride ourselves in collaborating with our clients to develop thoughtful investment plans to help them reach their goals. As we move forward into 2023, we believe investors continue to be best served by maintaining discipline and focusing on the long term view. We will continue to evaluate opportunities to reallocate portfolios as the investment environment evolves, and in taxable accounts we actively look to take advantage of volatility and add value by tax-loss harvesting.

Feel free to contact us if you have any questions.

Sources:

[1] Cleveland Fed Inflation Nowcast. https://www.clevelandfed.org/indicators-and-data/inflation-nowcasting

[2] New York Times. “A Host of Tech Companies Announce Hiring Freezes and Job Cuts.” https://www.nytimes.com/2022/11/03/technology/tech-companies-hiring-freeze-job-cuts.html

[3] Federal Reserve December 14th, 2022 FOMC Statement. https://www.federalreserve.gov/newsevents/pressreleases/monetary20221214a.htm

[4] CNBC “The Fed projects raising rates as high as 5.1% before ending inflation battle.” https://www.cnbc.com/2022/12/14/the-fed-projects-raising-rates-as-high-as-5point1percent-before-ending-inflation-battle.html

[5] JPMorgan. Guide to the Markets, Slide 17. https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

[6] JPMorgan. Guide To the Markets, Slide 4. https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

[7] JPMorgan. Guide to the Markets, Slide 40. https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

Important Information

Advisors Financial, Inc. (“AFI”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where AFI and its representatives are properly licensed or exempt from licensure.

The information provided is for educational and informational purposes only and does not constitute investment advise and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.