2nd Quarter 2023: Mid-Year Review and Outlook

Summary:

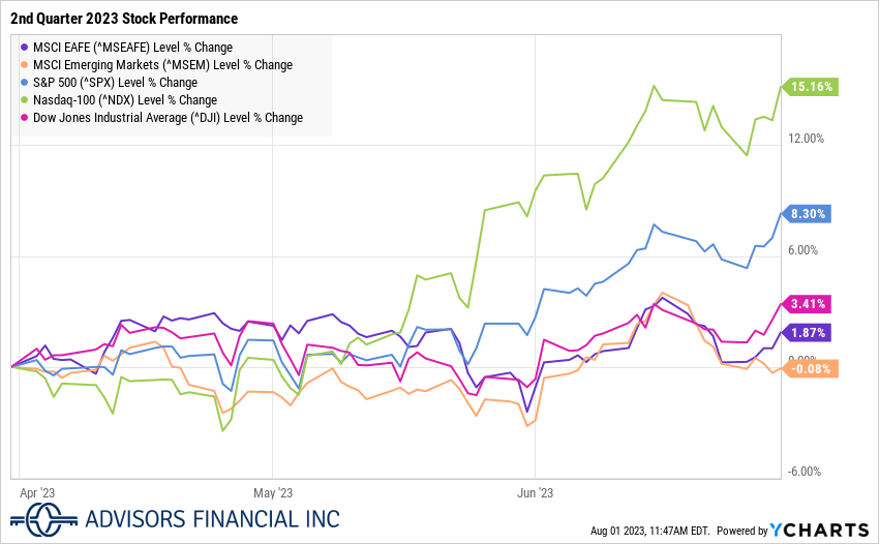

- The US stock market displayed robust growth in the second quarter, with the S&P 500 index gaining 8.3% and the NASDAQ 100 advancing by 15.16%. Developed international and emerging market stocks were mostly flat during the quarter.

- Bond performance was mostly flat during the quarter, but investment grade corporate and high yield bonds are up for the first half.

- The US economy added 732,000 jobs in Q2, but job growth decelerated slightly compared to Q1, and the unemployment rate rose marginally to 3.6%.

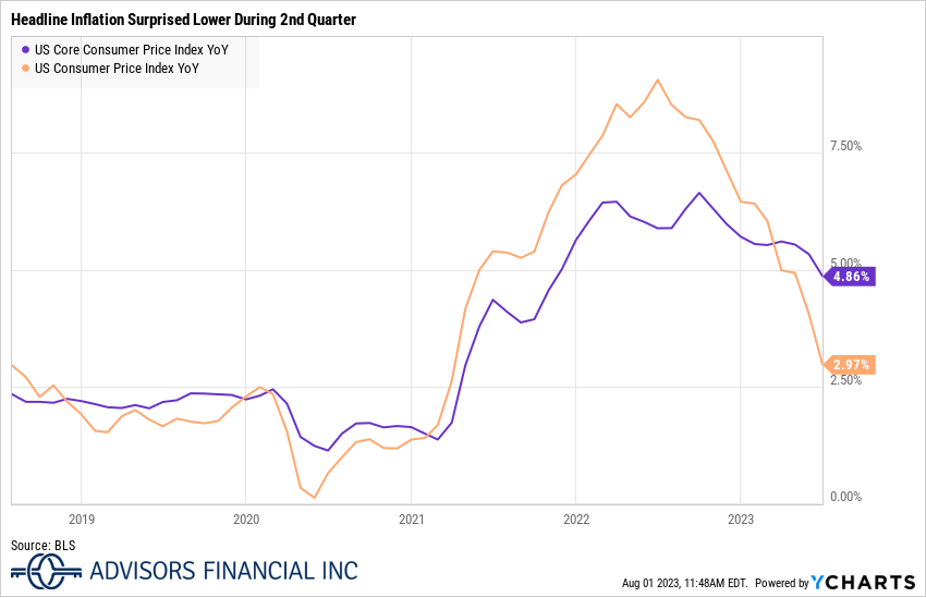

- Inflation saw a surprise decrease, dropping to 2.97% in June, well below expectations. The unexpected drop in inflation raised hopes that the Federal Reserve could achieve its 2% inflation target without a recession.

- The strong stock market performance was concentrated in a handful of stocks and driven by decreased inflation, greater clarity on interest rates, and the building buzz around artificial intelligence (AI) which is seen as transformative for numerous industries.

- We reduced our recession probability forecast to less than 50% over the next 12 months due to the resilience of the economy and lower than expected inflation. However, we are cautious due to high equity valuations and moderating economic growth, with fixed income markets offering attractive buying opportunities.

- Diversification is crucial in this environment; investors are best served by maintaining discipline and staying the course.

Market Analysis

The second quarter added more steam to the first quarter’s rally, with US stocks posting robust growth. The S&P 500 index of large cap stocks advanced by 8.3% to close the first half of 2023 up by almost 16%, while the NASDAQ 100 index of technology companies added 15.16% for a stellar first-half performance of 38.75%. This was a significant comeback for the NASDAQ considering it declined by more than 30% in 2022.

Developed international and emerging markets stocks were largely flat during the quarter as the US Dollar showed some signs of stabilization.

On the fixed income front, investment grade (IG) corporate bonds[i] fell by 38 basis points (0.38%) on a total return basis but ended the first half up 4.26%. High yield corporate bonds[ii] increased by 78 basis points to close the first half up 4.48%.

Job growth decelerated during the quarter, but labor markets continued to show strength. The US economy added 732,000 jobs in the second quarter and the unemployment rate ticked marginally higher to 3.6%. The four-week moving average of initial claims for unemployment insurance increased modestly to 257,000 at the end of June, before declining in July.

Inflation was the big surprise during the quarter. The June Consumer Price Index (CPI) dropped to 2.97%, well below expectations, from 4.05% in May. Just last July the CPI peaked at 9.06%. Core Personal Consumption Expenditures (PCE), the Fed’s preferred measure of inflation which strips out food and energy prices, dropped to 4.1% in June from 4.6% in May. The sharper than expected drop in inflation fueled hope that the Fed may be able to achieve its 2% inflation goal without a recession.

|

|

|

The strong stock market performance this year has not only been fueled by falling inflation and interest rate clarity. According to Bloomberg, references to “AI” are up drastically on technology company earnings calls in 2023 compared to in 2022, while recession references are down[iii].

Investors have been buzzing since the introduction of large language models and generative AI used by platforms like OpenAI’s Chat GPT and Adobe Photoshop. AI is viewed as a transformative technological development that will have far-ranging impacts across all industries, changing the way companies conduct business and customers consume goods and services. While it is too early to say whether we are in an “AI Bubble,” we do believe that AI will have far reaching impacts across industries as it develops. Transitional shifts and long-term trends often start with a buzz before sorting out the substance later.

Outlook

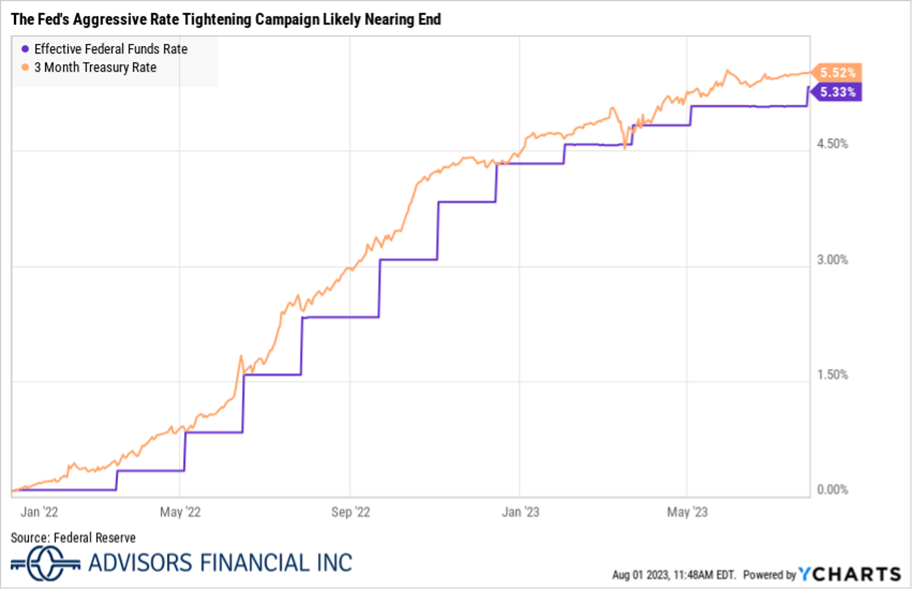

As new economic data comes in, we are constantly reevaluating our forecasts. Given the economy’s resilience and lower-than-expected inflation, we now see the chance of a recession as less than 50% over the next 12 months. History suggests that interest rate tightening cycles are almost always followed by rising unemployment and recession. We still believe this is true, but we just have not yet seen concrete signs that a recession is imminent. One of the most dangerous idioms in investing is “this time is different,” but it would be foolish of us to ignore the data as we see it. As always, we continue to evaluate new data as it is available and adjust our forecasts as necessary.

Looking forward, it is important to recognize that the stock rally this year has been fueled almost entirely by multiple expansion, not earnings growth. The forward price-to-earnings (PE) ratio of the S&P 500 increased from 17.8 times at the end of March to 19.1 times at the end of June. The 25-year average multiple is 16.8 times.

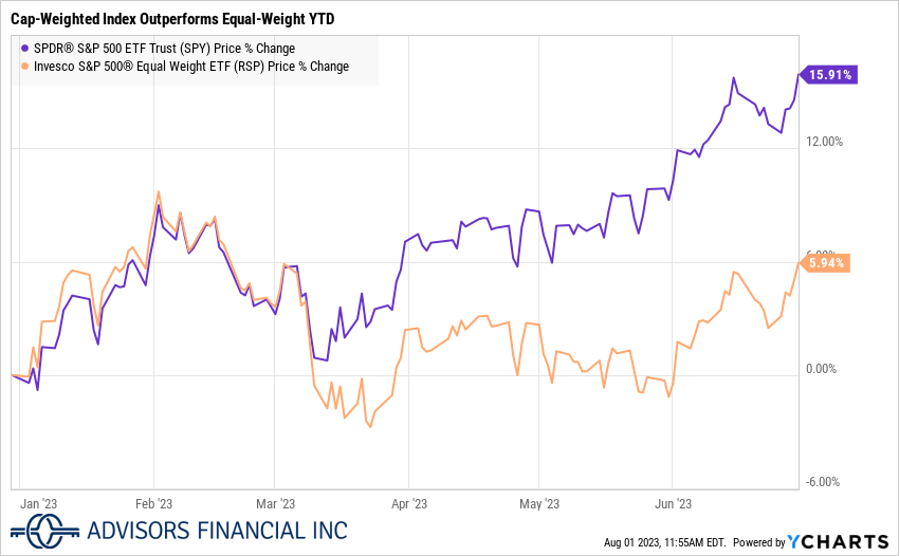

The rally has also been highly concentrated in a handful of mega-cap companies[iv].

The top ten stocks in the S&P 500 account for almost 32% of the total market cap of the index. Yes, that means more than 30% of the value of the 500 largest companies in the United States is concentrated in only 10 stocks! The PE ratio of the top ten is 29.3 times compared with only 17.8 times for the rest of the index. The chart below shows the dispersion between the market-cap weighted SPDR® S&P 500 ETF (SPY) and the Invesco S&P 500® Equal Weight ETF (RSP) in the first half of 2023.

|

|

|

Sources:

[i] As measured by the iShares iBoxx $ Investment Grade Corporate Bond ETF (symbol LQD)

[ii] As measured by the iShares iBoxx $ High Yield Corporate Bond ETF (symbol HYG)

[iii] Bloomberg, “AI Mentions on the Rise as Recession Talk Fades” https://www.bloomberg.com/news/articles/2023-07-28/ai-mentions-on-the-rise-as-recession-talk-fades-tech-watch?in_source=embedded-checkout-banner

[iv] JPMorgan. Guide to the Markets, Slide 11. https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/

[v] JPMorgan. Guide to the Markets, Slide 6. https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/

Important Information

Advisors Financial, Inc. (“AFI”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where AFI and its representatives are properly licensed or exempt from licensure.

The information provided is for educational and informational purposes only and does not constitute investment advise and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.